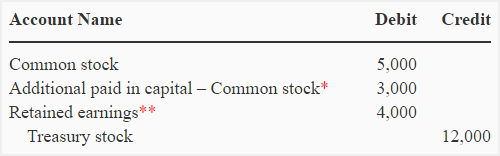

Under the par value method, the Treasury Stock account should be viewed as contra to the Capital Stock account. Its balance represents only the claims arising from the original investment of par value that were satisfied by distributing assets. If the cost is less than the original issue price, Additional Paid-In Capital should be credited. If the cost exceeds the original issue price, Additional Paid-In Capital or Retained Earnings should be debited.

How to Find a Company’s Treasury Stock

On the cash flow statement, the share repurchase is reflected as a cash outflow (“use” of cash). Our accounting firm is a professional service firm that focuses on providing expert advice in accounting and tax. They are able to provide our clients with the most accurate and reliable solutions for their particular financial/accounting needs.

What is a treasury stock method?

Ask a question about your financial situation providing as much detail as possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Ask a Financial Professional Any Question

When stock is repurchased for retirement, the stock must be removed from the accounts so that it is not reported on the balance sheet. The balance sheet will appear as if the stock was never issued in the first place. The treasury stock method formula to calculate the total number of diluted shares outstanding consists of all basic shares, and the new shares from the hypothetical exercise of “in-the-money” options and conversion turbotax itsdeductible of convertible securities. This method assumes that options and warrants are exercised at the beginning of the reporting period, and a company uses exercise proceeds to purchase common shares at the average market price during that period. The cost method is the most commonly used method by most public entities. It uses the value paid by the company during the repurchase of the shares and ignores their par value.

The result is that the total number of outstanding shares on the open market decreases. Treasury stock remains issued but is not included in the distribution of dividends or the calculation of earnings per share (EPS). Treasury stock is also referred to as treasury shares or reacquired stock. When reselling the shares, regardless of whether the company makes a gain or loss on the resale, the accounting treatment will be the same under the treasury stock par value method.

- At this point, if the sum of credit side of the journal entry is less than the sum of debit side, additional paid-in capital account will be credited for the difference.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- The market value of both bonds and stocks is determined by the buying and selling activity of investors in the open market.

- This is done in the amount of the par value of the shares being repurchased.

However, in case of losses, only losses equal or below the total balance of the additional paid-in capital account are set off against the balance. If the total losses on the transaction exceeds the total balance of the additional paid-in capital account, the excess losses are set off against retained earnings account. Treasury stock transactions can only reduce the retained earnings of a company and cannot increase them back. An alternative method of accounting for treasury stock is the constructive retirement method, which is used under the assumption that repurchased stock will not be reissued in the future. Under this approach, you are essentially reversing the amount of the original price at which the stock was sold.

Thus, one way the corporation can avoid dividend restrictions is to purchase treasury stock. As a result, when creditors require restrictions on dividend payments, they also often require restrictions on treasury stock purchases. The remaining $1,500 difference of the $4,500 economic loss is charged to Paid-in Capital From Sale of Common Stock Above Par.

The transaction will require a debit to the Paid-in Capital from Treasury Stock account to the extent of the balance. If the transaction requires a debit greater than the balance in the Paid-in Capital account, any additional difference between the cost of the treasury stock and its selling price is recorded as a reduction of the Retained Earnings account as a debit. If there is no balance in the Additional Paid-in Capital from Treasury Stock account, the entire debit will reduce retained earnings. Under the par value method, the treasury stock account is debited to decrease total shareholders’ equity at the time of share repurchase. This is done in the amount of the par value of the shares being repurchased. Treasury stock is an account created for any shares that are repurchased by a company only if the company intends to resell those shares.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. If more than one class of stock exists, separate disclosures should be made for the treasury stock of each class. Such stock, which is held in the corporate treasury, loses its right to vote, receive dividends, or receive assets upon liquidation.