Depreciation expense is considered a non-cash expense because it does not involve a cash transaction. Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations. The various methods used to calculate depreciation include straight line, declining balance, sum-of-the-years’ digits, and units of production, as explained below. Subtracting accumulated depreciation from an asset’s cost results in the asset’s book value or carrying value.

Why does accumulated depreciation have a credit balance on the balance sheet?

Without depreciation, a company would incur the entire cost of an asset in the year of the purchase, which could negatively impact profitability. Accumulated Depreciation is credited when Depreciation Expense is debited each accounting period. After the 5-year period, if the company were to sell the asset, the account would need to be zeroed out because the asset is not relevant to the company anymore. Therefore, there would be a credit to the asset account, a debit to the accumulated depreciation account, and a gain or loss depending on the fair value of the asset and the amount received.

Is Accumulated Depreciation an Asset or a Liability?

A depreciation method commonly used to calculate depreciation expense is the straight line method. Depreciation is an accounting method for allocating the cost of a tangible asset over time. Companies must be careful in choosing appropriate depreciation methodologies what does the credit balance in the accumulated depreciation account represent that will accurately represent the asset’s value and expense recognition. Depreciation is found on the income statement, balance sheet, and cash flow statement. It is accounted for when companies record the loss in value of their fixed assets through depreciation.

How Ron Passed His CPA Exams by Going All In

With offices in Miami, Coral Gables, Aventura, Tampa, and Fort Lauderdale, our CPAs are readily available to assist you with all your income tax planning and tax preparation needs. In addition, there is another technique called the double-declining balance method that allows for an asset to be depreciated even faster, based on its straight-line depreciation amount multiplied by 200%. For purposes of the units of production method, shown last here, the company’s estimate for units to be produced over the asset’s lifespan is 30,000 and actual units produced in year one equals 5,000. It estimates that the salvage value will be $2,000 and the asset’s useful life, five years. Below is a break down of subject weightings in the FMVA® financial analyst program.

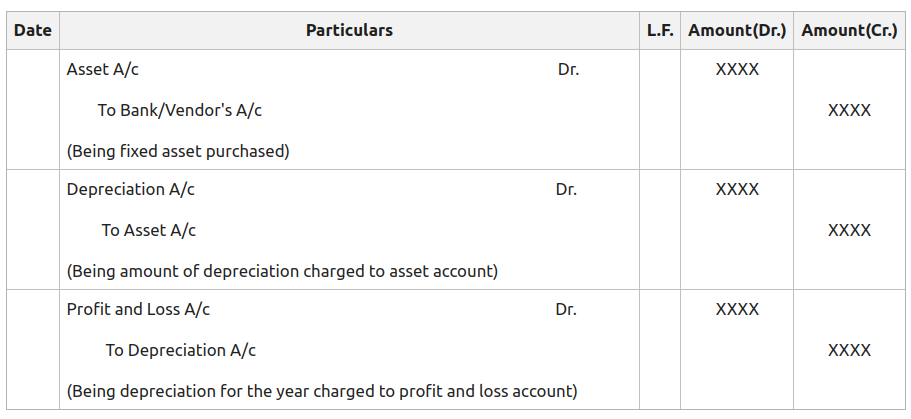

Accumulated depreciation is a real account (a general ledger account that is not listed on the income statement). The accounting entries for depreciation are a debit to depreciation expense and a credit to fixed asset depreciation accumulation. Each recording of depreciation expense increases the depreciation cost balance and decreases the value of the asset. Accumulated depreciation is initially recorded as a credit balance when depreciation expense is recorded. Depreciation expense is a debit entry (since it is an expense), and the offset is a credit to the accumulated depreciation account (which is a contra account).

- Over the years, accumulated depreciation increases as the depreciation expense is charged against the value of the fixed asset.

- It is recorded on a company’s general ledger as a contra account and under the assets section of a company’s balance sheet as a credit.

- The truck has an estimated useful life of 5 years and a residual value of $10,000.

- Generally the cost is allocated as depreciation expense among the periods in which the asset is expected to be used.

Depreciation spreads the expense of a fixed asset over the years of the estimated useful life of the asset. The purpose of depreciation is to match the cost of a productive asset, that has a useful life of more than a year, to the revenues earned by using the asset. This example illustrates how accumulated depreciation works and why it has a credit balance on the balance sheet. The credit balance serves to reduce the book value of the asset over time, reflecting its depreciation or loss of value. So, the credit balance in accumulated depreciation serves multiple purposes, including reflecting the asset’s current value, aiding in capital maintenance, and offering tax benefits. The amount of accumulated depreciation for an asset will increase over time, as depreciation continues to be charged against the asset.

Depreciation expense affects the values of businesses and entities because the accumulated depreciation disclosed for each asset will reduce its book value on the balance sheet. Generally the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. Such expense is recognized by businesses for financial reporting and tax purposes.

For accounting purposes, the depreciation expense is debited, and the accumulated depreciation is credited. Depreciation expense is a portion of the capitalized cost of an organization’s fixed assets that are charged to expense in a reporting period. It is recorded with a debit to the depreciation expense account and a credit to the accumulated depreciation contra asset account. Another difference is that the depreciation expense for an asset is halted when the asset is sold, while accumulated depreciation is reversed when the asset is sold. Accumulated depreciation is the total amount of deprecation that has been charged to-date against an asset. It is stored in the accumulated depreciation account, which is classified as a contra asset.