For example, Lynx Boating Company produces three different lines of boats (sport boats, pontoon boats, and large cruisers). All three boat lines are profitable, but the pontoon boat line seems to be less profitable than the other two types of boats. Management may want to consider abandoning the pontoon line and using that additional capacity to produce one of the other more profitable lines. The Controller, or Chief Management Accountant, is responsible for all accounting functions, including providing relevant information to managers at all levels of management. Managerial accountants can use constraint analysis to reduce operational inefficiencies by leveraging historical data to streamline processes. A company’s control over bottlenecks has a direct correlation to profitability, so this is a big one.

Integration with Other Business Tools

With the right approach and tools, developing and maintaining effective SOPs becomes a streamlined process that pays dividends for years to come. If you’re ready to take your accounting operations to the next level, start for free with Whale today and let us help you create SOPs that work for you. Busy professionals often choose self-paced programs that allow for part-time attendance; however, this typically lengthens completion time. Some students prefer attending local on-campus or online programs to enhance networking opportunities in their area.

Types of managerial accounting methods

Experience the best of both worlds with V2 Cloud’s virtual desktop solutions, where you can host all your favorite accounting applications with the flexibility of the cloud and the familiarity of a local desktop. The knowledge-sharing tool that centralizes all of your standard operating procedures, policies, and internal knowledge so you can better onboard, train and grow your teams. Larger schools often provide more student resources, but small schools often provide more individualized attention. I know there are many different routes available to you, but trust me when I say the CMA is the best. Part 2 of the CMA exam covers professional ethics, and all CMAs must complete annual ethics training as a part of their continuing professional education, or CPE requirements. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Managerial Accounting Defined

Management accountants generate the reports and information needed to assess the results of the various evaluations, and they help interpret the results. Management accounting, also known as managerial accounting, is the process of analyzing information about a company’s finances, interpreting it and using it to make decisions about the business. Managers of various teams and departments create reports such as budgets, financial forecasts and schedules and present them to senior management for decision-making.

- Management accounting principles in banking are specialized but do have some common fundamental concepts used whether the industry is manufacturing-based or service-oriented.

- Accreditation standards matter for credit transfers, access to federal financial aid, and hireability.

- Meanwhile, WilkinGuttenplan, based in East Brunswick, New Jersey, has employees working across 11 states.

- Managerial accounting, also called management accounting, is a method of accounting that creates statements, reports, and documents that help management in making better decisions related to their business’ performance.

Internships can provide invaluable experience that can enhance your resume and create professional connections. Even if not a requirement for your degree program, seek internship options if possible. Learn about managerial accounting the different types, careers, and how to enter this field. Next-generation accountants want their firm to invest short term payday loans online in them as much as they’re investing in the firm. That’s why the top Best Firms for Young Accountants all have professional development in common. That can look like reimbursements for continued education, CPE courses and tracking, CPA exam prep, days off for taking the exam, bonuses for passing, and support groups for those studying.

What Is Management Accounting?

This sets the stage not only for success but also for a strong and trust-based partnership with the franchisor—and gets everyone on the same page for the long haul. The use of qualified professional accountants or a CPA who has prior experience in franchise accounting assists in audits and reporting, and performance improvements. They can also be of great help when it comes to budgeting and money estimations, ensure compliance, and identify cost-saving opportunities. Cloud accounting is a modern approach to financial management, using internet-based software to perform essential accounting functions, such as tracking expenses, managing accounts, and generating reports.

However, most accounting bachelor’s programs feature core courses in accounting information systems, auditing, and intermediate and advanced accounting. Some bachelor’s programs also require completion of a capstone project and/or internship at a real-world site. Given the time length involved in many plans, the organization also needs to factor in the potential effects of changes in their senior executive leadership and the composition of the board of directors.

To get a job in managerial accounting, you’ll need to earn your bachelor’s degree, gain professional experience, and consider certification. Graduate degrees are not always required but may be required for some senior-level managerial accounting positions. Each employer may have their requirements, so it’s important to research the desired qualifications before pursuing your degree and applying to entry-level positions. Financial leverage refers to a company’s use of borrowed capital in order to acquire assets and increase its return on investments. Through balance sheet analysis, managerial accountants can provide management with the tools they need to study the company’s debt and equity mix in order to put leverage to its most optimal use.

For example, the goals might be stated in terms of percentage growth, both annually and in terms of the number of markets addressed in their growth projections. Managerial accounting is the process that allows decision makers to set and evaluate business goals by determining what information they need to make a particular decision and how to analyze and communicate this information. Let’s explore the role of managerial accounting in several different organizations and at different levels of the organization, and then examine the primary responsibilities of management.

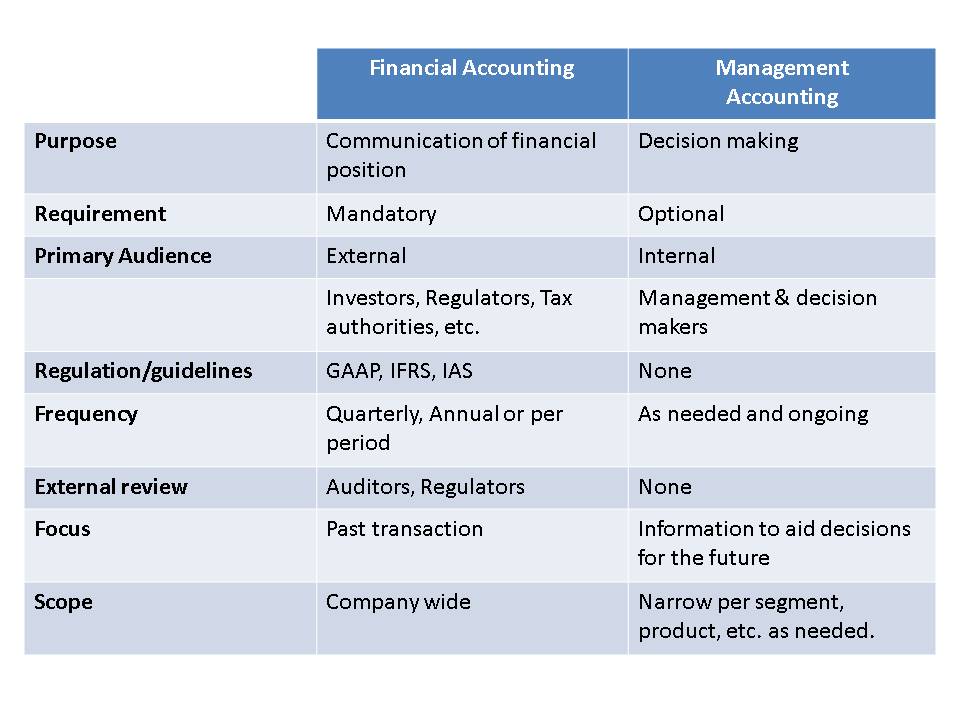

When a managerial accountant performs cash flow analysis, he will consider the cash inflow or outflow generated as a result of a specific business decision. For example, if a department manager is considering purchasing a company vehicle, he may have the option to either buy the vehicle outright or get a loan. A managerial accountant may run different scenarios by the department manager depicting the cash outlay required to purchase outright upfront versus the cash outlay over time with a loan at various interest rates. The key difference between managerial accounting and financial accounting relates to the intended users of the information. Managerial accounting information is aimed at helping managers within the organization make well-informed business decisions, while financial accounting is aimed at providing financial information to parties outside the organization.

Cloud accounting platforms offer automatic data backups, minimizing the risk of data loss. In case of technical issues or cyber threats, disaster recovery features ensure that data can be quickly restored, keeping business operations running smoothly. Whether you need to add users, integrate new functions, or upgrade services, these platforms can be scaled up or down easily, without the costly hardware changes required by traditional systems. The cloud-based software functions much like traditional accounting software, but instead of being installed on individual computers, it’s hosted on remote servers through a Software as a Service (SaaS) model. General accounting degrees expose students to a wider variety of accounting fields, areas, and topics.