Then, we compare the total to the cost assignment in step 4 for units completed and transferred and ending work in process to get total units accounted for. Once the equivalent units for materials and conversion are known, the cost per equivalent unit is computed in a similar manner as the units accounted for. The costs for material and conversion need to reconcile with the total beginning inventory and the costs incurred for the department during that month. Regardless of the costing system used, manufacturing costs consist of direct material, direct labor, and manufacturing overhead. Figure 8.61 shows a partial organizational chart for Rock City Percussion, a drumstick manufacturer.

Works-in-Progress vs. Finished Goods

Since the maximum number of units that could possibly be completed is \(8,700\), the number of units in the shaping department’s ending inventory must be \(1,200\). The total of the \(7,500\) units completed and transferred out and the \(1,200\) units in ending inventory equal the \(8,700\) possible units in the shaping department. These calculations are valid for the periodic inventory method, and not needed in the perpetual inventory method, where the costs of individual products and unfinished production (i.e., WIP) are tracked continuously. Knowing how to accurately calculate WIP inventory can impact your balance sheet. If your business offers highly customized products, then it’s important to understand how WIP inventory works, what goes into the cost, and how to calculate it at the end of the accounting period. This will give you a sense of COGS based on how much it costs to produce and manufacture finished goods.

Step Four: Allocating the Costs to the Units Transferred Out and Partially Completed in the Shaping Department

These 9,000 units will end up in one of two places, either completed and transferred out (to the Finishing department) or not completed and therefore in ending WIP inventory. Ann Watkins owns and operates a company that mass produces wood desks used in classrooms throughout the world. Ann’s company, Desk Products, Inc., maintains an advantage over its competitors by producing one desk in large quantities—4,000 guide to filing taxes as head of household to 8,000 desks per month—using a universally accepted design. This enables the company to buy materials in bulk, often leading to volume price discounts from suppliers. Because the exact same desk is produced for all customers, Desk Products purchases precut wood materials from suppliers. As a result, Desk Products can limit the production process to two processing departments—Assembly and Finishing.

Use a 3PL to help with inventory management

In addition to the equivalent units, it is necessary to track the units completed as well as the units remaining in ending inventory. A similar process is used to account for the costs completed and transferred. Reconciling the number of units and the costs is part of the process costing system. The reconciliation involves the total of beginning inventory and units started into production.

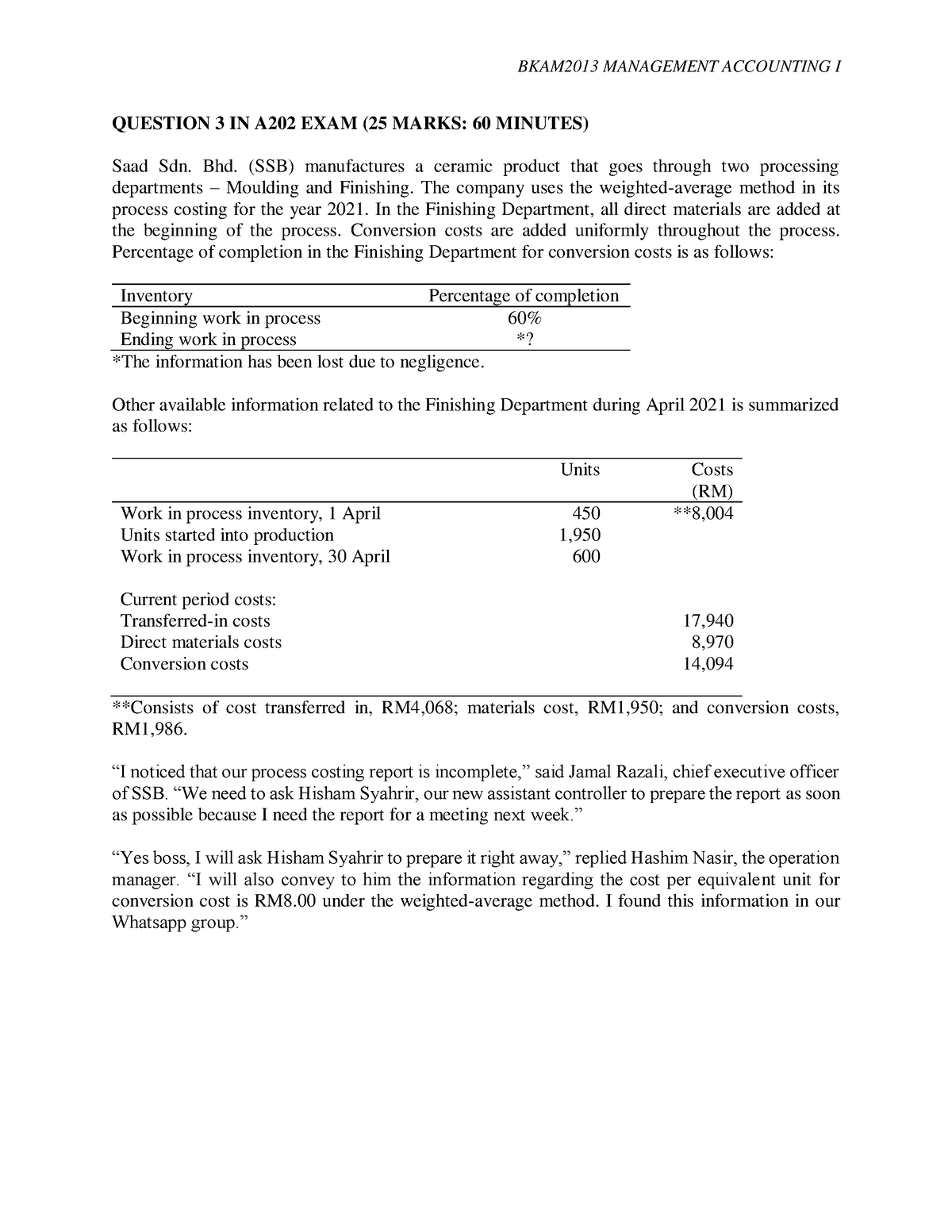

As for the equations, this means that beginning WIP costs can’t be included in total costs (i.e. in the numerator). I assume materials are added at the beginning of the process, so ending WIP units are 100% complete with respect to direct materials and transferred-in costs. We want to make sure that we have assigned all the costs from beginning work in process and costs incurred or added this period to units completed and transferred and ending work in process inventory.

- This enables the company to buy materials in bulk, often leading to volume price discounts from suppliers.

- This report shows the costs used in the preparation of a product, including the cost per unit for materials and conversion costs, and the amount of work in process and finished goods inventory.

- If there are no beginning WIP units, the two methods operate in exactly the same way.

- Work in process in production and supply chain management refers to the total cost of unfinished goods currently in production.

If you sum the three units completed products above, you have the total cost of units completed and transferred out. This is always the case when there are beginning WIP equivalent units. If there are no beginning WIP units, the two methods operate in exactly the same way. Again, the only difference between the two methods is that stinking beginning WIP.

In this example, two groups—administrative and manufacturing—report directly to the chief financial officer (CFO). The organizational chart also shows the departments that report to the production department, illustrating the production arrangement. The material storage unit stores the types of wood used (hickory, maple, and birch), the tips (nylon and felt), and packaging materials. A work-in-progress on a company’s balance sheet represents the labor, raw materials, and overhead costs of unfinished goods. Unfinished is defined as goods still being manufactured and not ready to be sold to consumers.

In accounting, WIP is an asset and designates the value of unfinished goods at the end of a financial period. With processing, it is difficult to establish how much of each material, and exactly how much time is in each unit of finished product. This will require the use of the equivalent unit computation, and management selects the method (weighted average or FIFO) that best fits their information system. The WIP figure reflects only the value of those products in some intermediate production stages.

For example, forty units that are 25% complete would be ten (40 × 25%) units that are totally complete. For the weighted average method, applying costs is relatively simple. You apply costs by multiplying the rates for direct materials, conversion costs, and transferred-in cost by (1) ending WIP equivalent units and (2) completed units. The weighted average method rips away the $15,000 of conversion costs from the beginning WIP units.

In accounting, WIP is an asset designating the combined value of all unfinished goods. Total manufacturing cost represents the total costs of all manufacturing activities for a financial period. It is calculated as the sum of the total costs of raw materials, labor, and overheads used in manufacturing for the period. Similarly to inventory and raw materials, the WIP inventory is accounted for as an asset in the balance sheet. All costs related to the WIP inventory, including the costs of raw materials, overhead costs, and labor costs, need to be considered for the balance sheet to be accurate. When a company mass produces parts but allows customization on the final product, both systems are used; this is common in auto manufacturing.